Job Market BLOG

SUMMARY: WSJ Analysis: Big Money in Today’s Economy is Going to Capital, Not Labor

DETAILS: Feeling like you can’t get ahead in today’s economy? You’re not alone. A February 9, 2026 analysis by Grep Ip at the Wall Street Journal breaks it down:

In 1985, IBM was America’s most valuable company, one of its most profitable, and among its largest employers, with a payroll of nearly 400,000.

Today, Nvidia is nearly 20 times as valuable and five times as profitable as IBM was back then, adjusted for inflation. Yet it employs roughly a 10th as many people.

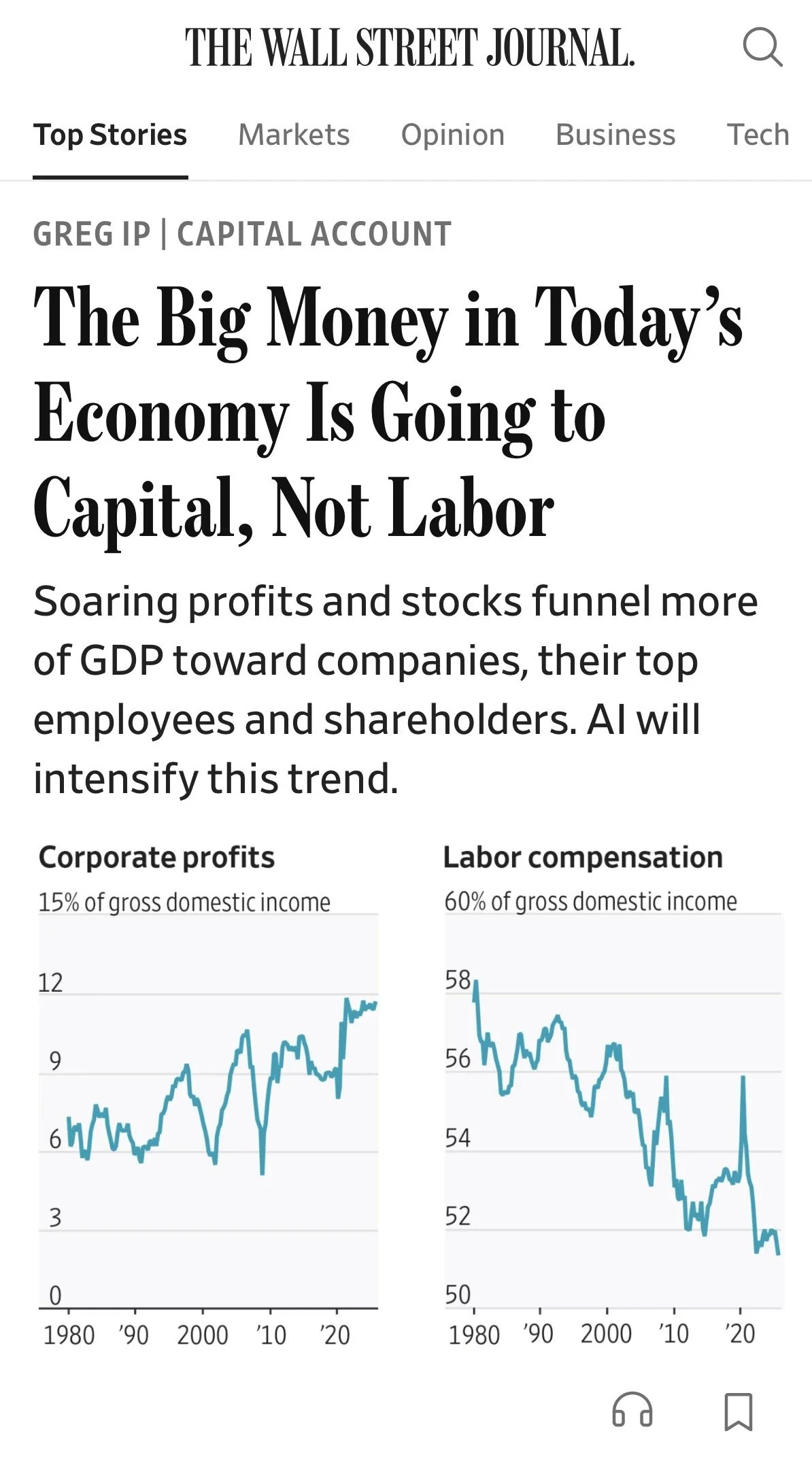

That simple comparison says something profound about today’s economy: Its rewards are going disproportionately toward capital instead of labor. Profits have soared since the pandemic, and the market value attached to those profits even more. The result: Capital, which includes businesses, shareholders and superstar employees, is triumphant, while the average worker ekes out marginal gains.

The divergence between capital and labor helps explain the disconnect between a buoyant economy and pessimistic households. It will also play an outsize role in where the economy goes from here.

Here’s a link to the full article (behind WSJ paywall). It’s an important read if you’re struggling to understand today’s job market.